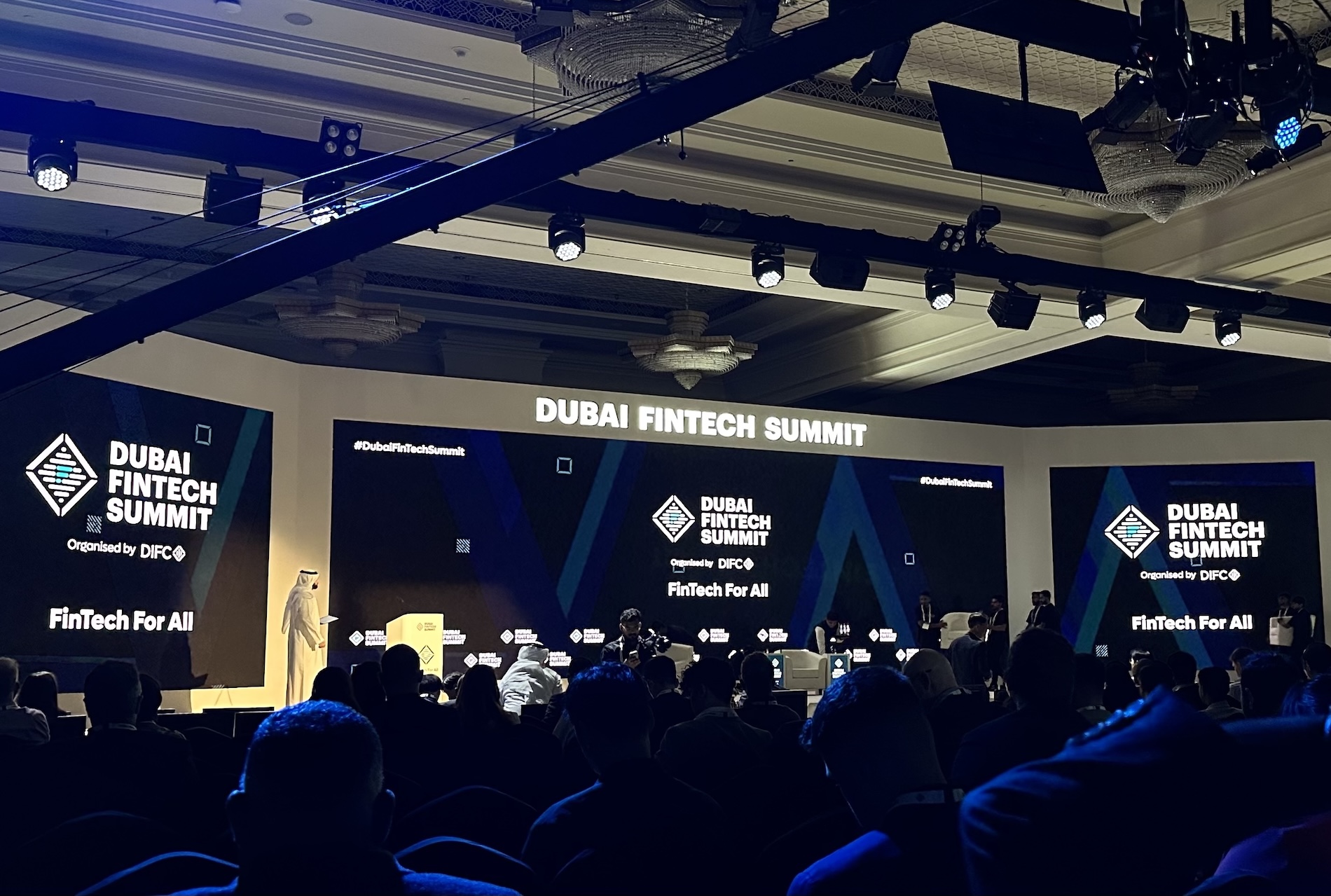

Organized by the Dubai International Financial Centre (DIFC), the Dubai FinTech Summit 2025 concluded on Tuesday after two dynamic days of global dialogue and strategic collaboration at Madinat Jumeirah, Dubai. The summit brought together over 9,000 participants from 120 countries, cementing its reputation as one of the largest and most influential fintech events worldwide.

Vijay Shekhar Sharma, Founder and CEO of Paytm, shared the story behind building one of India’s most transformative digital payment platforms. Meanwhile, the panel “Navigating the Future of IPOs” featured global market leaders, including Eun-bo Jeong (Korea Exchange), Bonnie Y Chan (Hong Kong Exchanges and Clearing Limited), and Charlie Walker (London Stock Exchange plc), who explored the future trajectory of global capital markets and IPO strategies. Monica Long, President of Ripple, spoke about the institutional DeFi and stablecoins being the foundation of a tokenized future.

Stimulating panel discussions included topics like “Shaping a Responsible Future” with leaders like Michael Faye, Co-Founder & Chief Executive Officer of TapTap Send; Ahmed Abdelaal, Group Chief Executive Officer of Mashreq; and Prof. Kitipong Urapeepatanapong, Chairperson of The Stock Exchange of Thailand.

“If you’re not using AI every day, then you’re not turbocharging your own potential,” Faye said while talking about sustainable economic growth.

A fireside chat with Matthew Koder, President of Global Corporate & Investment Banking at Bank of America, explored how the U.S. economy influences global finance. And the DIFC launched its first “Future of Finance” report, emphasizing AI-driven innovation in digital banking and cloud finance.

Another major highlight was the Grand Finale of the FinTech World Cup, where global finalists competed on Innovation Stage 2, unveiling cutting-edge fintech solutions in a high-stakes pitch showdown. The competition emphasized the summit’s commitment to spotlighting entrepreneurial talent and innovation.

Throughout both days, the summit cultivated meaningful engagement among central bank governors, C-suite executives, policymakers, and startups, with sessions covering everything from sustainable finance to the future of blockchain, digital identity, and AI-powered banking. The event featured keynote speeches, panel discussions, startup showcases, and networking opportunities.