In a rapidly evolving financial landscape, where technology plays an increasingly critical role, understanding the needs of today’s traders has never been more important. fintechview features Maria Pittashi, the General Director of PLUGIT, brings a wealth of experience and a forward-thinking approach to bridging the gap between brokerages and their clients. In this exclusive interview, Pittashi opens up about her vision for the future of trading platforms, the key challenges traders face today, and how Plugit is working to deliver innovative, tailor-made solutions that meet the demands of a dynamic and competitive market.

What is PLUGIT all about?

At PLUGIT, we are a technology provider for Forex Brokers. We aim to make brokers’ lives easier. That’s been our focus since 2012. We understand how complex and fast-moving the forex industry can be, and our goal is to simplify that where we can, whether it’s through better tools, smarter automation, or reliable support.

Our product suite, YOONIT, includes everything from CRM and IB management to copy trading, margin control, bonus automation, and more. Each module is designed to work on its own or as part of a larger setup, so brokers can choose what fits best for their business and build from there.

We don’t claim to have all the answers, but we do listen, and we care about the details that matter to our clients. The brokers we work with shape how we evolve, and we’re proud to be their trusted partners in technology that shapes the industry.

We don’t claim to have all the answers, but we do listen, and we care about the details that matter to our clients.

How have traders/investors’ needs evolved through the years?

It’s a question we think about a lot, especially as the industry continues to evolve, and this is what drives our innovation.

We’ve seen quite a shift over the years, especially as technology has become more accessible and expectations have changed.

A decade ago, traders mostly focused on execution speed and spreads. Now, they’re looking for control, transparency, and tools that match their individual strategies. With our clients, we’ve seen that there’s a stronger demand for real-time information to help them stay on top of analytics, client patterns, trends, and reporting, all allowing for better decision making. We’re also seeing more interest in risk management tools at the retail level, which used to be more of an institutional concern.

At the same time, the Broker’s end users (investors) tend to be more educated. They have more information readily available to them than in the past, they ask more questions, and they have higher demands from their Brokers. Trader’s are looking for Brokers that can offer portals where all their information is easily accessible, and with minimal interaction. They need systems that can adapt. And for Brokers, this means that the tech they offer needs to keep up, or they risk falling behind.

That’s where we’ve focused our efforts, working closely with our clients as partners, to understand what their clients are asking for, what’s slowing them down operationally, and where technology can make a meaningful difference. We focus on automating repetitive tasks, reducing risk exposure, or giving traders more visibility and control.

With the rising marketing and acquisition costs, an effective partner program is essential to brokers success. Your thoughts on this challenge.

It’s become obvious over the past few years that partner networks (whether IBs or affiliates) aren’t just optional anymore, they’re essential. As you mentioned, digital acquisition costs are climbing, and traditional marketing is becoming less predictable for brokers. They are having to rely more on referral-based growth. But while the model works, managing it properly is a whole other challenge for them.

Most of the friction we see comes down to brokers not having a system that’s designed for this kind of scale. A broker might have hundreds or even thousands of IBs and sub-IBs in different regions, languages, and structures. Trying to manage all of that manually, or with a system not built for it, just doesn’t scale. We’ve worked with many brokers facing this exact issue: spreadsheets, disconnected systems, lack of visibility on performance or payouts, poor reporting, limited scalability, and inflexible payout structures.

A lot of our work on the IB & Affiliate Management Tool comes directly from these pain points we kept seeing. It is a dedicated solution that helps brokers run efficient, transparent, and performance-driven partner programs. It’s now being used by some of the leading brokers in the industry, and what we hear most often is that it helps them focus more on growing their network, not just managing the admin behind it.

We understand that for our client’s it’s not just about tracking commissions, it’s about giving their partners the kind of experience that makes them want to keep referring business to them.

Which are some of the common forex risk management mistakes you see and brokers should avoid?

One of the most common mistakes we see is treating risk management as something reactive, rather than something built into the day-to-day operations. A lot of brokers wait until they’re exposed to high volatility, unexpected client behavior, or liquidity gaps before reassessing their risk settings. By then, it’s often too late to respond effectively.

Another issue is over-reliance on static margin rules, especially in fast-moving markets. What worked last quarter might not work tomorrow. We’ve focused so much on helping brokers automate that part of the process through our Dynamic Margin solution. As our top selling module, we see Brokers of all sizes find the obvious value in using such a tool. It gives them the flexibility to set smarter rules and adapt in real time, rather than relying on manual interventions.

We also see situations where risk management is isolated within the Brokerage, disconnected from marketing, sales, or even compliance. In reality, all of those departments impact exposure. For example, bonus campaigns or aggressive acquisition strategies can unintentionally open up vulnerabilities if risk isn’t factored in from the start.

So the advice we’d give is for Brokers to treat risk as something to design into the system early on. The Brokers who take that approach tend to run leaner operations, have fewer surprises, and are better prepared when the market tests them.

What solutions do you offer to brokers and what’s your competitive advantage?

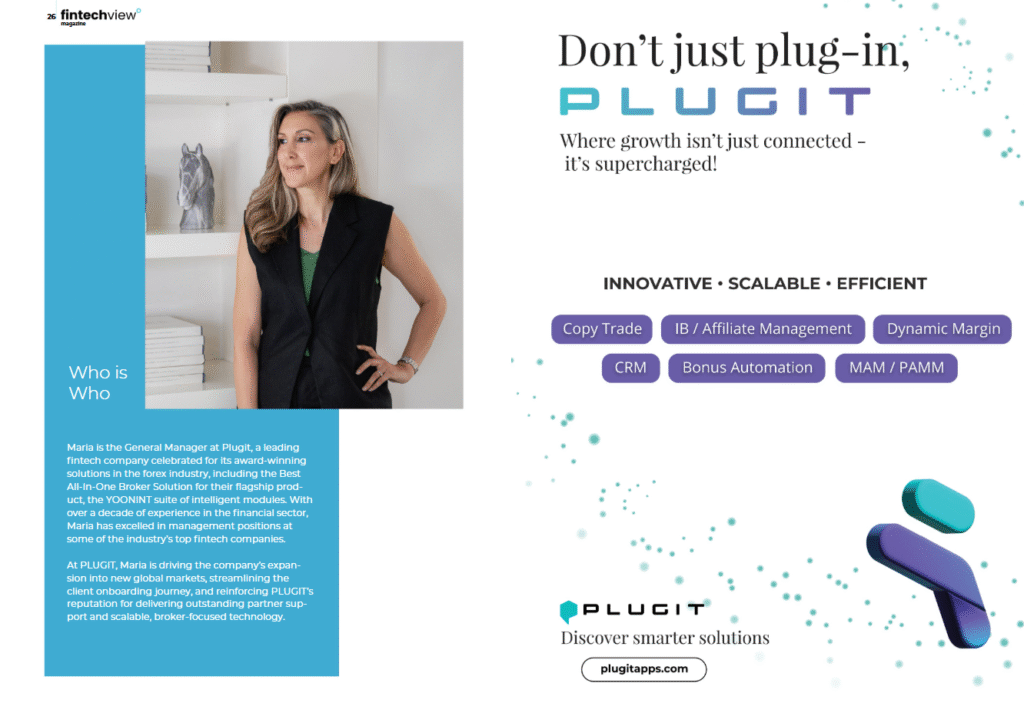

At PLUGIT, we offer a modular suite of solutions designed specifically for forex brokers. Our platform, called YOONIT, includes the following tools: IB and Affiliate Management, Copy Trade, Bonus Automation, MAM/PAMM, Dynamic Margin, and CRM solution. Each module can work on its own or as part of a larger setup, depending on what the broker needs. That flexibility is important because no two brokers operate in the same way, and we find that our clients benefit from our adaptability.

As for what sets us apart, we don’t try to be everything to everyone. We focus on solving real operational challenges brokers face every day. A lot of what we’ve built has come directly from working closely with our clients, understanding their pressure points, and improving based on their feedback.

Our competitive advantage is our focus and experience in the market. We work with some of the largest Brokers in the industry, and working alongside them for the past 12 years as they push our products to the limit, has made our products resilient and strong. We also move quickly with our support, which is something many brokers tell us they value, and isn’t necessarily something they find amongst other providers.

How is AI transforming financial services technology, and in what ways is PLUGIT integrating it into its strategic vision?

AI is definitely reshaping the way all businesses operate. For us, it’s less about the hype and more about using it in meaningful ways. For instance, we are prioritising the value and speed it brings when delivering support, training, and knowledge to our clients.

Brokers today are surrounded by information, and while that can be powerful, it can also be overwhelming. Our goal is to help them simplify, make it easier for them to understand our products, and troubleshoot any issues faster and more efficiently than it’s ever been before.

We know we’re still at the beginning of this journey, but it’s a direction we’re fully committed to. As our products continue to evolve and become more sophisticated, the way we support them has to evolve as well, and naturally, AI is an important part of that process.

What’s coming up next for PLUGIT?

We’re always working on something… that’s just how we operate. A lot of it is shaped by what we’re hearing from Brokers, what’s shifting in the market, and where we think we can genuinely add value.

While we’re not ready to share specifics just yet, what’s ahead is definitely aligned with everything we stand for: practical innovation, flexibility, and keeping brokers one step ahead of the curve.

So yes, keep an eye on us.

who is who

Maria is the General Manager at Plugit, a leading fintech company celebrated for its award-winning solutions in the forex industry, including the Best All-In-One Broker Solution for their flagship product, the YOONINT suite of intelligent modules. With over a decade of experience in the financial sector, Maria has excelled in management positions at some of the industry’s top fintech companies. At PLUGIT, Maria is driving the company’s expansion into new global markets, streamlining the client onboarding journey, and reinforcing PLUGIT’s reputation for delivering outstanding partner support and scalable, broker-focused technology.

Check out the digital magazine here.