EXCLUSIVE INTERVIEW: Andreas Livadiotis, CEO & Founder XValley Techologies Ltd

The cover story on our latest digital issue, explores how XValley enhances the B2B landscape in the fintech sector. An exclusive interview, Andreas Livadiotis, the visionary CEO and Founder of XValley Technologies, a leading provider of Forex and Crypto turnkey solutions, shares with us his career journey and how under his leadership, the company has become a go-to fintech powerhouse.

We’re not just building solutions; we’re shaping how brokerages grow, compete, and succeed in an ever-changing market. That’s why I believe XValley is the game-changing brokerage solutions provider!

What are the fintech B2B trends in 2025, businesses should not ignore?

AI and automation are going to dominate 2025, and we dedicated the theme of CFS (Cyprus Fintech Summit) in December 2024 to the role of AI within fintech. The event was a real success and we’re looking forward to CFS 2025 later on this year.

From smarter risk management algorithms to predictive analytics that help brokers make data-driven decisions, AI is becoming essential. Embedded finance is also growing, and we’re seeing the need to integrate more payment solutions directly into platforms. And let’s not forget about personalisation. Brokers will need to offer tailored trading experiences based on user behaviour. At XValley, we’re already ahead of the curve, integrating AI-driven tools and keeping our clients on the cutting edge. We’ll be making a few really cool announcements soon.

At XValley, you offer a full brokerage solution. Could you share information on the services you offer?

Absolutely! At XValley, we’ve built a complete and mature brokerage ecosystem that empowers forex and crypto brokers to hit the ground running. Our core offering includes a powerful, bespoke trading platform, a fully integrated CRM & client area, a comprehensive risk management system, and a robust liquidity bridge. But that’s just the beginning! We also provide a host of modules that are built to seamlessly plug into the XValley ecosystem.

Included in our suite of modules are the Prop Trading, MAM/PAMM, Copy Trading & Social Trading, Portfolio Management, Cashier / Payment Orchestrator, and Live Chat modules. And that’s just scratching the surface! In short, we provide everything a brokerage needs to scale and succeed, all under one roof.

How has the trader’s profile changed throughout the years and how has this impacted the needs of a brokerage firm?

Traders today are savvier and more demanding than ever. They know what they want, and they also know how to investigate a broker before making their first deposit. From what we’re seeing at XValley, and through conversations with our clients, traders now expect instant execution, zero downtime, and access to a variety of trading tools.

Social trading and copy trading have exploded, as has the need for transparency and personalised experiences. This shift has forced brokerages to up their game, meaning they need to offer more tailored solutions and engaging platforms. That’s why we’ve baked social trading, prop trading, and advanced analytics into the XValley ecosystem, so brokers can meet these evolving demands head-on.

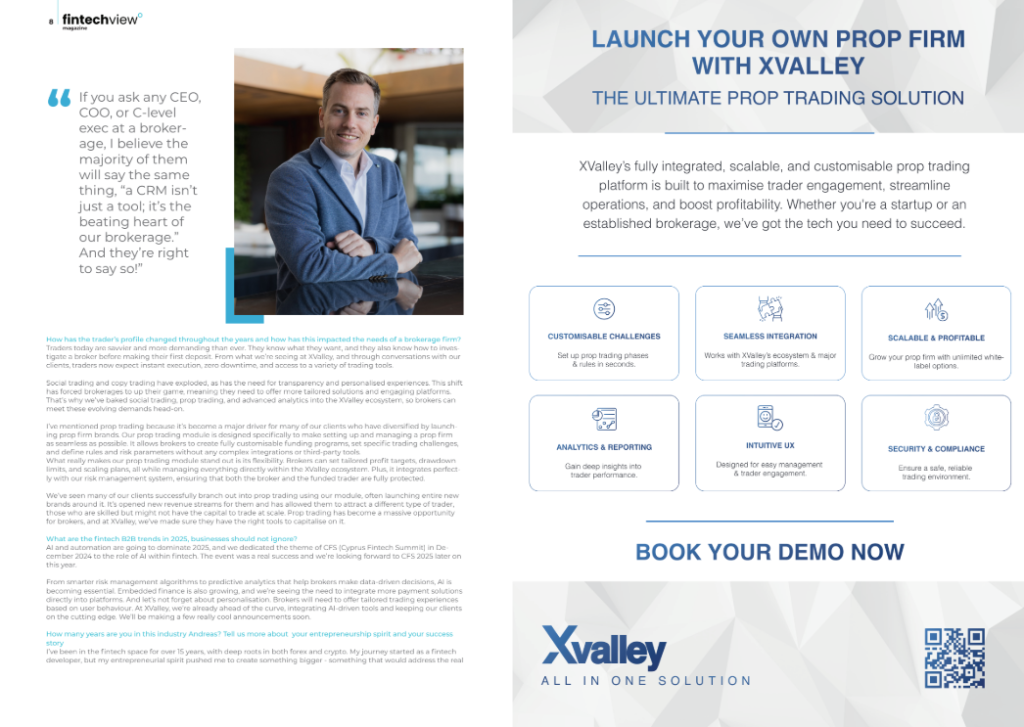

I’ve mentioned prop trading because it’s become a major driver for many of our clients who have diversified by launching prop firm brands. Our prop trading module is designed specifically to make setting up and managing a prop firm as seamless as possible. It allows brokers to create fully customisable funding programs, set specific trading challenges, and define rules and risk parameters without any complex integrations or third-party tools.

What really makes our prop trading module stand out is its flexibility. Brokers can set tailored profit targets, drawdown limits, and scaling plans, all while managing everything directly within the XValley ecosystem. Plus, it integrates perfectly with our risk management system, ensuring that both the broker and the funded trader are fully protected.

We’ve seen many of our clients successfully branch out into prop trading using our module, often launching entire new brands around it. It’s opened new revenue streams for them and has allowed them to attract a different type of trader, those who are skilled but might not have the capital to trade at scale. Prop trading has become a massive opportunity for brokers, and at XValley, we’ve made sure they have the right tools to capitalise on it.

At XValley, we’re not just a tech provider, we’re a partner. We walk alongside our clients, helping them grow, optimise, and scale without sacrificing performance or breaking the bank.

What’s XValley unique selling point and how do you differentiate from the competition?

What really sets XValley apart is how streamlined and mature our ecosystem is. Since launching in 2015, we’ve seen the FX & Crypto spaces evolve drastically, and we’ve grown alongside them, tailoring our ecosystem to align with all the regulatory changes. One of the biggest differentiators? Our ecosystem isn’t a patchwork of third-party tools duct-taped together. We built the framework first, and that solid foundation is what allows the entire XValley ecosystem to flourish.

Every module we add slots in perfectly because it’s designed to work within our own framework. Think of it like an iPhone and its App Store. The iPhone’s hardware and software are built to work seamlessly, and the apps integrate effortlessly. That’s how our framework and modules work together. There’s flawless integration without the headaches. This approach not only streamlines the entire system but also allows us to keep costs low, making XValley an attractive and realistic proposition for both start-up and established Forex & Crypto brokerages.

Plus, by eliminating the need for multiple providers, we reduce the usual headaches brokers face when juggling seven or more service providers. But it’s not just about cutting costs. Our clients love that they only need to deal with one company, us. We simplify operations and offer tailored solutions because we know that no two brokers are alike. Need a custom module? No problem. We thrive on building unique tools to meet specific needs. At XValley, we’re not just a tech provider, we’re a partner. We walk alongside our clients, helping them grow, optimise, and scale without sacrificing performance or breaking the bank.

What are the features and challenges a broker should consider to ensure he has the right CRM solution?

If you ask any CEO, COO, or C-level exec at a brokerage, I believe the majority of them will say the same thing, “a CRM isn’t just a tool; it’s the beating heart of our brokerage.” And they’re right to say so!

The right CRM should go far beyond basic client management. It needs to offer advanced lead tracking, a dedicated sales & partners portal, seamless KYC integrations, straightforward payment processing, real-time analytical risk monitoring, and automated workflows that streamline daily operations. It should also give a full 360-degree view of client activities, making it easier for brokers to personalise their services and increase retention.

One of the biggest challenges brokers face is scalability. As their trader &partner base grows, so do operational complexities. The right CRM must not only manage the current workload but also be flexible enough to grow with the brokerage.

At XValley, we’ve designed our CRM to be fully modular, so brokers can start simple and scale as they grow. Whether it’s integrating new payment providers, adding custom reports, or expanding sales pipelines, our CRM evolves with the brokerage.

Another major challenge is maintaining compliance. There’s been a glacial shift in regulatory requirements, and they’re changing constantly. A CRM needs to not just help brokers stay ahead without slowing them down, but empower them to do so. XValley’s CRM integrates KYC and AML tools directly into the workflow, automating compliance checks and reducing manual errors.

Finally, ease of use is often overlooked. A powerful CRM is useless if teams can’t navigate it easily. That’s why we focused on a clean, intuitive interface that makes complex tasks simple, so brokers can focus on growing their business rather than wrestling with clunky software.

We see brokers following a multi-branding solution in the last few years. How complicated is this from your point of view and can XValley support this?

Multi-branding can get messy fast if your systems aren’t built for it. Juggling multiple brands with different setups often leads to inefficiencies, duplicated efforts, and rising costs. But when it comes to XValley, we make multi-branding simple.

Our ecosystem is designed from the ground up to support multiple brands, entities, and white labels under a single umbrella. Brokers nowadays don’t just use one regulatory band such as CySEC. All of our clients use multiple regulators, ranging from CySEC, FCA, through to FSC, FSA, FSCA, and a host of others.

With the XValley ecosystem, brokers can easily manage everything from one centralised CRM, making it effortless to scale and diversify their offerings. Setting up a new brand, entity, or white label is straightforward and really easy, too. We’ve created it this way so that there’s no need for complicated integrations or starting from scratch. Within the XValley CRM, you can configure multiple entities, each with its own distinct settings, trading conditions, KYC rules, and payment providers, all while maintaining shared access to the broader ecosystem.

Managing multiple brands becomes seamless with shared liquidity pools, unified risk management, and centralised reporting. You can monitor performance across all brands from one dashboard while still maintaining granular control over each brand’s specific operations. In addition, with our flexible white-label solution, brokers can easily onboard partners or launch region-specific brands without additional tech headaches. Everything is built to scale, so whether you’re running two brands or twenty, the process stays smooth and efficient.

With XValley, multi-branding isn’t a challenge, it’s an opportunity to scale smarter.

..with our flexible white-label solution, brokers can easily onboard partners or launch region-specific brands without additional tech headaches. Everything is built to scale, so whether you’re running two brands or twenty, the process stays smooth and efficient. With XValley, multi-branding isn’t a challenge, it’s an opportunity to scale smarter.

Read the full interview at fintechview digital magazine #4 edition.

Who is Who

Andreas is the founder of XValley Technologies Ltd, a firm with vast tailor-made services, focused on developing and trading software for diverse global clientele within the financial industry. Upon completing his education of BSc in Computer Science and MSc in Finance in London, he held roles in fintech and forex companies, such as FxPro, PrimeXM and FBME Bank with projects in MT4, MT5, and cTrader. He founded his own company, XValley Technologies in 2015.